Dixafinance is a global systematic investment platform. Our centralized research focuses on the development of advanced quantitative techniques for uncovering market opportunities and employs them within a disciplined framework that results in efficient exposures.

With a robust infrastructure and talented investment professionals, Dixafinance offers clients the scale of a large asset management firm, with the benefits of a versatile investment platform – flexibility and customization. Our firm is able to offer institutional and retail investors the essential building blocks for today’s changing investment landscape.

Using advanced methods of making business and a personal approach to each investor, we propose a novel financing example to people who want to maximize earnings, but also as a strong source of solid returns.

Dixafinance company uses only advanced trading tools and trades at the most steady markets, which minimizes the uncertainty of financial loss to investors and guarantees them a steady income accrued every calendar day.

OUR PRINCIPLES AND AMBITIONS

WE APPROACH SUSTAINABILITY FROM THREE PERSPECTIVES: AN ASSET OWNER, AN ASSET MANAGER, AND AS A COMPANY IN OUR OWN RIGHT

While our responsibilities and obligations in each of these three roles may differ, as we discuss below, our approach in all three is united by a common set of principles and ambitions, set out in the box at the bottom of the page.

We serve as an asset owner on behalf of Prudential With-Profts policyholders, and our pensions and annuity customers. This means we make decisions about how to allocate money to different asset classes and which asset manager should manage our money.

We also have the important responsibility of deciding the financial outcomes we want our asset managers to deliver for us, and the sustainability considerations we require them to apply.

For example, if we think that a certain industry does not have a sustainable future, we may require that the asset manager does not invest in that industry. Our responsibility as an asset owner is to create the best customer outcome in terms of general well-being in line with our fiduciary duty, taking into consideration financial security.

We also invest as an asset manager on behalf of individual savers and asset owner clients. As at 31 December 2020, we manage over £233.4 billion for external clients and £133.8 billion on behalf of our internal client.

As an asset manager, we must aim to deliver the financial outcomes and any sustainability requirements set out in the objectives of each of our mutual funds, or in the mandates we receive from institutional clients.

Sometimes there may be differences in the sustainability criteria that external clients mandate, and in turn these may differ from the requirements of our internal client.

While our values of care and integrity inform all our sustainability work, the asset manager and asset owner are separately regulated businesses with independent Boards and governance processes, and their policies may diverge on occasion.

Our sustainability principles:

– We will consider sustainability and ESG factors when determining our corporate strategy and new business initiatives.

– We will embed sustainability considerations throughout our business.

– We identify and incorporate ESG risk factors into our general risk management process.

– We consider the interests of all our stakeholders and ensure our views on sustainability are consistent with our longterm approach.

– We will manage our businesses to the same principles of acting responsibly that we hold our investee companies to account on.

– We review our sustainability thinking regularly in order to align with scientific and technological improvements, and changes in the global economy, ethics and consumer preferences.

– We aspire to be a thought leader, to innovate, and to advance understanding of sustainability issues.

– We aim to use our influence as a global investor and asset owner to drive positive change in sustainability policy and corporate standards.

– We believe in active asset ownership and management which encourages companies to transition towards a sustainable future.

CORE PRINCIPLES

We are a trusted fiduciary of client assets.

– Our priority is always to act in the best interests of our clients.

– No one will ever outwork or outhustle us for business.

– We conduct business with the highest level of honesty and integrity.

– We strive to generate superior returns in our chosen markets.

– Creativity is at the core of our investment approach.

– We work collaboratively, intelligently and judiciously.

– Our most important asset is our people.

– We strive to recruit and retain the best talent.

– We stress teamwork in everything we do.

– We value the opinion of every member of the firm and seek consensus across all investment decisions.

– We give back to the communities in which we work and live.

OUR SUSTAINABILITY STRATEGY: UNDERPINNED BY CONSTANT EVOLUTION AND A LONG-TERM APPROACH

ESG INTEGRATION

We integrate environmental, social and governance information into our analysis and decision-making across our investment teams and business lines.

STEWARDSHIP

We are active stewards of the entities in which we invest; this goes hand-in-hand with our active investment approach.

CORPORATE RESPONSIBILITY

ESG is ingrained in our business activities through our corporate responsibility program. This includes our Barings Social Impact philanthropic program, as well as our focus on diversity, equity and inclusion across our business.

DEDICATED RESOURCES

Our dedicated resources help develop and deliver our sustainability and ESG strategy, policy, partnerships, research, training and reporting.

INDUSTRY PARTNERS

We are a signatory to the Principles for Responsible Investment, a member of the United Nations Global Compact and Climate Action 100+, and public supporters of the Task Force on Climate-related Financial Disclosures. We work to advance the missions of these industry partnerships.

FORMAL GOVERNANCE

Our Sustainability Committee consists of senior business leaders and is tasked with supporting sustainability strategy execution.

Our Sustainability Working Groups focus on long-term strategic projects and regularly meet and report to the Sustainability Committee.

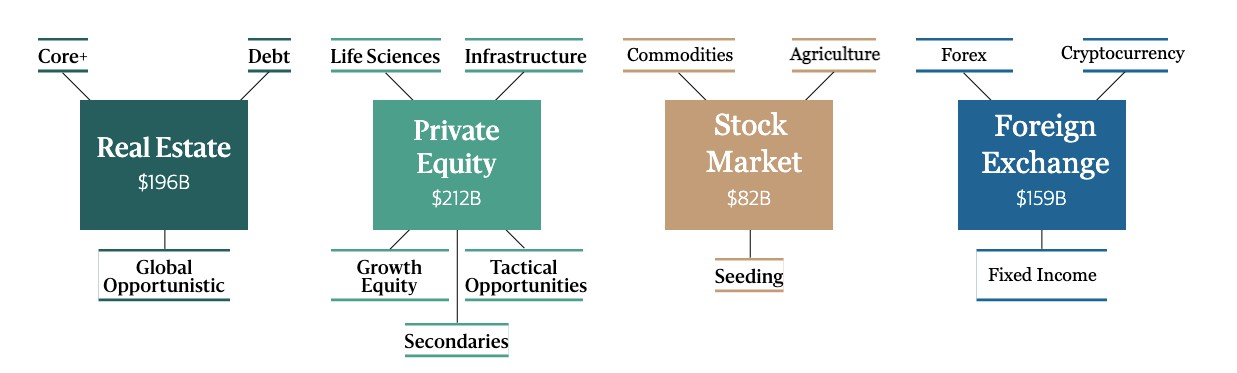

$649B AUM

We continue to build on our track record to innovate into new strategies, drive growth, and serve our investors.

HOW WE WORK

OUR VALUES

At the heart of our business are our partners: the entrepreneurs and management teams we back; the investors in our funds; the advisers and intermediaries we work with; and the banks and other lending institutions to our deals.

Highly Ambitious

We strive to build world-class businesses to generate superior returns for our partners.

Winning

We are here to win. We are constantly improving, and are committed to out-thinking and out-executing our competitors. We take on what others dismiss as impossible, and solve the hard problems that others walk away from. This is why we hire the best.

Integrity

We do things the right way, without compromise, the first time – every time. We are direct, decisive and, above all, accountable. We practice sound judgment and common sense in our actions that conforms to the letter and spirit of the law at all times. We win on the merits, with integrity.

Learning

We are driven by a thirst for knowledge. We are constantly learning – from each other and from inspired thinkers around the world. We passionately pursue new ideas, new innovations and new strategies that will strengthen our competitive advantage